According to the U.S. Labor Department, the inflation rate for consumer goods and services hit a 30-year high in October, representing an increase of 6.2 percent compared to the same time last year. This marked the fifth straight monthly increase of 5 percent or more, and it was the fastest annual surge since 1990.

As noted in its Wednesday announcement, the Labor Department published that the price hikes were broad-based, with the largest increases occurring in the categories of energy, shelter, food, used cars and trucks, and new vehicles. Specifically, the energy index rose 4.8 percent last month, as the gasoline index increased 6.1 percent – other major energy sectors rose as well.

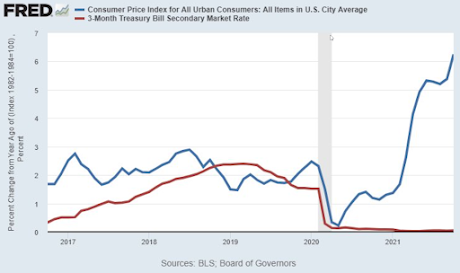

From a month-to-month basis in 2021, inflation increased a seasonally adjusted 0.9 percent in October – representing a more than double increase from the 0.4 percent rise in September, while also matching June’s 0.9 percent pace. This chart from the Bureau of Labor Statistics shows the monthly breakdown over the past four years.

After the inflation numbers were released at 8:30am ET yesterday, Bitcoin rose as high as $68,744 at 9:19am and Ethereum climbed to $4,848.61 at 11:14am – each setting new records. However, as of this writing, both dipped nearly 4 percent respectively. Both coins have been very bullish in recent months, doubling in price since this past June.

Possible reasons for the earlier price surge for these two leading cryptocurrencies are Bitcoin’s fixed asset supply of 21 million coins, and Ethereum’s recent move to limit its own supply by burning miner rewards as part of its EIP- 1559 upgrade in August. Both features are deflationary in nature and position both digital currencies as effective shields against macro-inflationary pressures.

On The Flipside

- This is the very reason why Bitcoin was created, to empower individuals with a degree of economic equality and protect their financial well being from governmental policy vagrancy.

Why You Should Care?

Despite what politician’s say, this inflationary trend is not transitory – it’s systemic. If you don’t have some type of inflationary hedge within your portfolio, contact a financial advisor and find an investment to help protect your store of value and purchasing power.

from DailyCoin.com https://ift.tt/3c1KG1l

https://ift.tt/3c3TOlY

0 Comments