- The Curve DAO Token (CRV) is the native token that powers the Curve.fi decentralized exchange.

- Equilibrium has launched Curve.fi’s automated market maker on Genshiro, Equilibrium’s Kusama-based canary network.

- The crypto pool of Curve Finance was recently launched on the Harmony Protocol, granting users access to all the tokens on Curve.fi.

- The price of the Curve DAO Token has doubled in the last month, setting a new yearly high of $5.3 in the process.

The Curve DAO Token (CRV) is an Ethereum-based token that powers the Curve.fi ecosystem, a blockchain-based decentralized exchange using automated market makers. The Curve protocol connects users who wish to exchange ERC-20 tokens and stablecoins.

Being the native token of the Curve Finance ecosystem, CRV is used for governance voting and claiming protocol fees on the network. In the last 30 days, the Curve DAO Token has been one of the most talked-about cryptos. Here’s why.

Curve DAO Token (CRV) Price Updates

Most cryptos have experienced significant pull-backs since the ETF-powered rally helped major cryptos to hit new all-time highs. The Curve DAO Token has been one of the stand-out performers, recording gains while the market retraced.

In the last 24 hours, CRV has gained by more than 20%, sending the price up to a new yearly high of $5.30. Over the last 30 days, the price of the Curve DAO Token has more than doubled, with CRV gaining 115% in the process.

On the back of its recent gains, the Curve DAO Token (CRV) is now trading at $5.04470, at the time of writing. Curve Finance is ranked as the 63rd largest crypto project, with a market cap of $2.089 billion.

The 30 day price chart for the Curve DAO Token (CRV). Source: Tradingview

Sustaining this bullish momentum will see CRV retest a 12-month high of $5.6. If CRV breaks through the resistance level of $5.6, the token could rally up to $6.1 before meeting another test.

Recent Developments and Future Developments

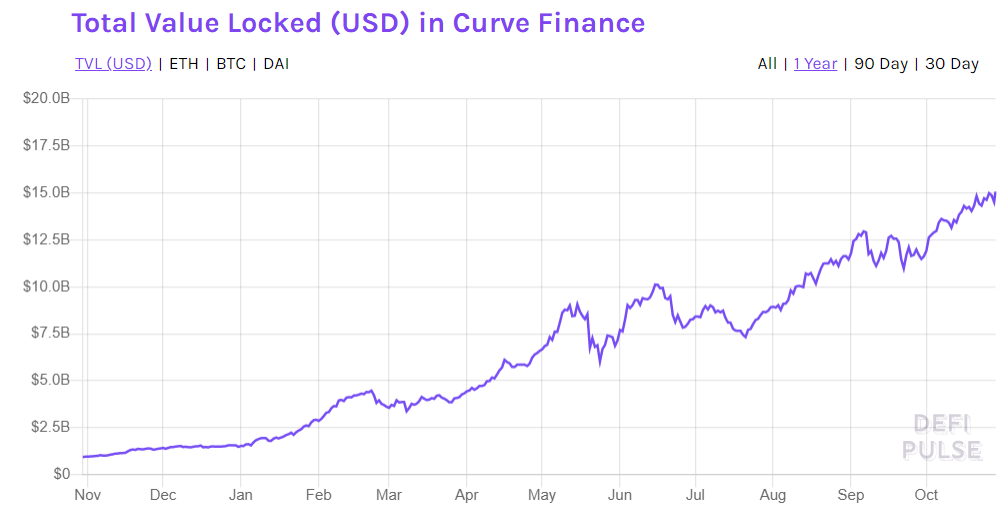

Along with its recent price boost, Curve Finance has recorded major growth in 2021. At the start of the year, the total value locked (TVL) in Curve Finance was approximately $1.5 billion.

The total value locked in Curve Finance over the last 12 months. Source: DeFi Pulse

As of October 28th, Curve Finance has a TVL of $15.07 billion, making it the 3rd largest decentralized finance protocol. Along with CRV’s price rise, the Curve Finance network has been at the center of some remarkable growth.

On October 26th, Equilibrium, a DeFi money market, announced that it had launched the official implementation of Curve.Fi’s automated market maker, Epsilon, on the Kusama Network. Epsilon makes Curve.fi’s AMM interoperable between Ethereum and the Binance Smart Chain.

Epsilon is currently featured on Genshiro, Equilibrium’s Kusama-based canary network. Looking toward the future, Equilibrium has revealed that Epsilon will also be integrated into the Polkadot network, giving it more reach.

Prior to launching on Kusama, the crypto pool of Curve Finance was launched on Harmony Protocol. Harmony is a fast and open blockchain for decentralized applications. Harmony users can now access all of the pools on the Curve.fi network.

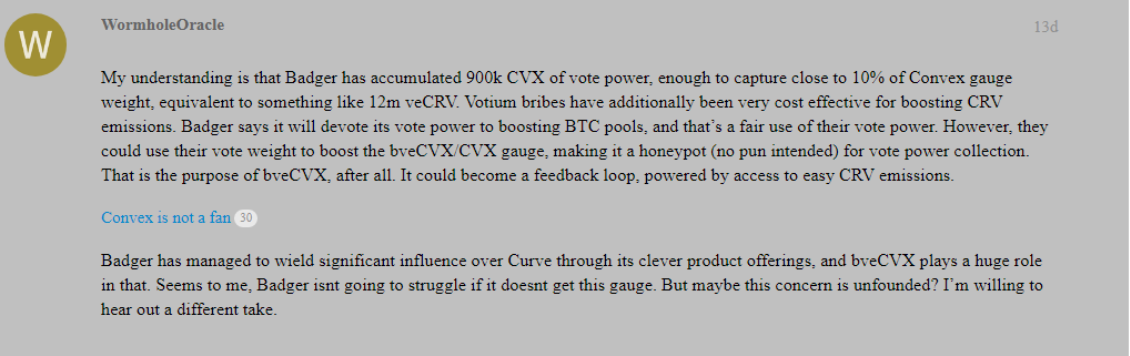

Curve is a fully decentralized network that gives users the ability to vote for or against developments on the network. Users are currently voting on a proposal to add bveCVX (which is issued by Badger, a DAO protocol dedicated to bringing BTC to DeFi.) & CVX factory pool 17 to the Gauge Controller of the Curve.fi network.

On The Flipside

- Regardless of the recent strong performance of Curve DAO Token (CRV), the token lies far below its all-time high.

- In August 2020, CRV hit an ATH of $60.50. As of this writing, the token is trading at 91% less than it was over a year ago

Community

Curve Finance is a community-driven protocol that is not reliant on one organization or team. Community members discuss and vote for changes and updates to the network via gov.curve.fi. For example, WormholeOracle, in reacting to the proposal from Badger, wrote;

you made me a believer, I'm in the $crv army - the coin is trending, lots of ppl talking about it, i like the energy behind it, lets go

— Jay Torres (@JuneBeBugging) October 28, 2021https://t.co/xgzyhjwj0F$crv #curvedaotoken

Cheering the Curve DAO token higher, @lerosbutcher, wrote;

GM master!$crv #curvedaotoken is a peach!!!

— Giannis_nČB (@lerosbutcher) October 28, 2021

Already 4X+ up from the July low and nowhere near it's top!

I can read an easy 4x from where it's standing, with the market structure we have!

What do you feel about it?

Another user, Bal Porsuğu, shared the Social performance of the project, writing;

Curve DAO Token 1-day social activity:

— Bal porsuğu (@Bal_pors) October 28, 2021

Galaxy Score65 out of 100

AltRank14 out of 3216

1,290 social mentions

5,800,906 social engagements

59 social contributors

0.05% social dominance

129 shared linkshttps://t.co/FoaUAi2Eel$crv #curvedaotoken #LunarShare pic.twitter.com/yShf72r3rS

Why You Should Care?

While Curve Finance has been in the news for its immense gains over the last 30 days, it is one of the most efficient AMMs to pair with similar assets. After experiencing a suboptimal start to life in the crypto space, Curve Finance is finally gaining attention for its strong performance as a decentralized exchange.

from DailyCoin.com https://ift.tt/3k2etLB

https://ift.tt/3GLhlq3

0 Comments