Earlier this month Bitcoin officially became legal tender in El Salvador. Country President Nayib Bukele made the initial announcement back in June that Bitcoin would be a parallel currency in El Salvador. To facilitate adoption, his government also launched a digital wallet called Chivo to enable Bitcoin as a method of exchange.

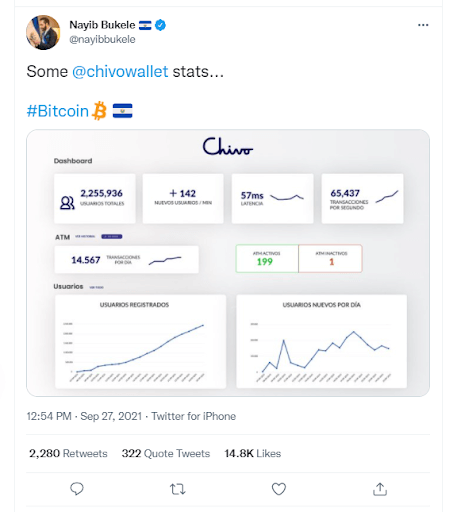

Earlier this week, President Bukele tweeted to his millions of followers that more than 2.2 million Salvadorans have downloaded the Chivo wallet, adding more than 140 new users per minute.

Critics were skeptical whether Bitcoin could scale at a country-level, and Bukele stated that the Lightning Network has been able to average around 65,4000 transactions per second – so the network seems stable as well. To drive usage, the Salvadorian government deposited $30 worth of Bitcoin into each wallet.

Not only is Bitcoin gaining ground in Central America, its momentum is building in some Latin American countries as well.

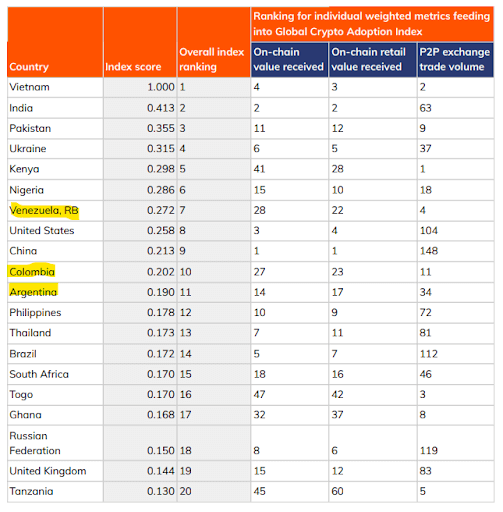

According to Chainalysis’ most recent Global Crypto Adoption Index, three Latin American countries are in the global top-20 of fastest crypto uptake: Venezuela (#7), Colombia (#10), and Argentina (#11) respectively.

The index researchers found that emerging countries, such as those in Latin America, ranked due to their high volume of peer-to-peer (P2P) transactions once wealth-per-capita and internet-use multipliers were calculated. The report also found that many residents in developing economies rely on P2P crypto exchanges since they don’t have access to centralized exchanges.

The index also states that many developing markets have severe inflation, forcing residents to convert their fiat currencies into crypto to preserve value, as well as the following factors:

“Others in these areas use cryptocurrency to carry out international transactions, either for individual remittances or for commercial use cases, such as purchasing goods to import and sell. Many emerging markets represented here limit the amount of the national currency that residents can move out of the country. Cryptocurrency gives those residents a way to circumvent those limits so that they can meet their financial needs.” (Chainalysis, pg. 6).

In addition to those countries, Uruguay, Panama, and Paraguay are continuing to craft and consider various pieces of legislation that would make it easier to use virtual currencies within their respective borders.

On The Flipside

- Emerging countries are outpacing developed countries when it comes to crypto adoption.

- In the Chainalysis index, since last year, the U.S. slid from sixth to eighth in the ranking, while China fell from fourth to 13th — in large part due to its ongoing crypto crackdown.

Why You Should Care?

According to a Deloitte report, more than three quarters of global banking executives surveyed believe that we will no longer be using physical fiat currency within 10 years. Countries that fall behind in the crypto adoption race might be at a competitive disadvantage for years to come.

from DailyCoin.com https://ift.tt/3oSZXcl

https://ift.tt/3iOX2NV

0 Comments